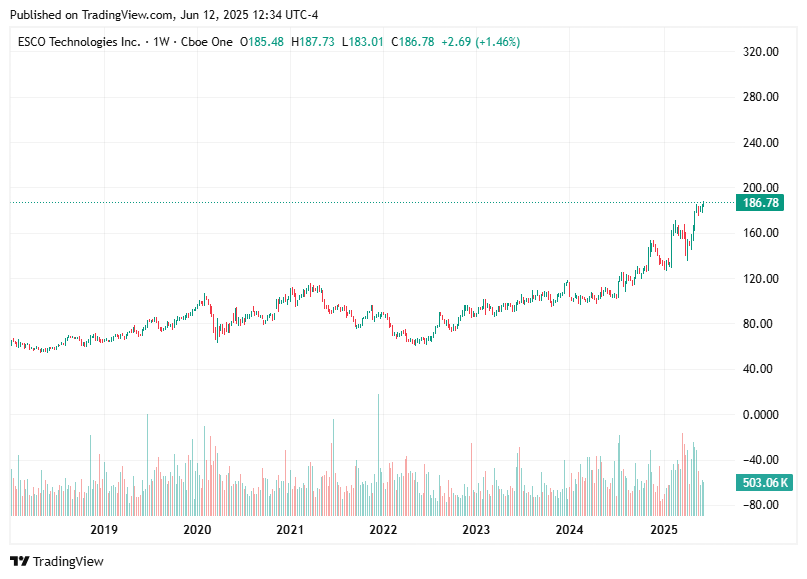

Low Float in Price Discovery Territory.

Breakout Industrial Player Delivers Across Key Metrics, Signaling Further Growth Potential

Esco Technologies Inc. (ESE) has delivered a compelling financial performance in its second quarter of fiscal year 2025, reinforcing its momentum as a high-potential growth stock. The company reported adjusted earnings per share (EPS) of $1.35, which exceeded analyst expectations by nearly 8 percent and marked a 24 percent year-over-year increase.¹ This beat extends a consistent pattern of outperforming quarterly forecasts, as ESCO also exceeded projections in Q1 by $0.34 per share.² These results are supported by a 7 percent revenue increase to $265.5 million and a 33 percent rise in GAAP EPS, solidifying the company’s strong current quarterly earnings performance.³

In terms of annual earnings growth, ESCO has demonstrated a steady upward trajectory in both net income and top-line revenue. Over the past three fiscal years, revenue has increased from $857 million to $956 million and most recently to over $1 billion.⁴ Likewise, net earnings grew from $82.3 million in FY2022 to $101.9 million in FY2024.⁵ This progression, paired with a record backlog of $932 million and a book-to-bill ratio of 1.10, reflects robust demand across its business lines and underpins the company’s multi-year growth profile.⁶

A key driver of the company’s trajectory is its recent acquisition of SM&P, now operating as ESCO Maritime Solutions. This new division is expected to contribute $90 to $100 million in annual revenue and strengthens the company’s position in the naval defense space.⁷ The acquisition reflects ESCO’s commitment to introducing new products and services, while also expanding its technological capabilities. Notably, the company’s stock recently hit an all-time high of $187.73 on June 9, confirming a technical breakout supported by operational success.⁸

In the realm of supply and demand, ESCO benefits from favorable dynamics. The float is tight, at approximately 25.35 million shares, and the short interest remains low—just 1.29 percent—indicating minimal bearish pressure.⁹ Furthermore, a spike in trading volume accompanied the recent breakout, a clear sign of institutional accumulation.¹⁰ This institutional demand underpins recent price action and reinforces the stock’s strength on the technical side.

Evaluating whether ESCO is a leader or laggard, the stock has appreciated by approximately 73 percent over the past twelve months and 40 percent year-to-date, outperforming both its industrial sector peers and broader market benchmarks.¹¹ Its leadership status is reinforced by its ability to generate consistent earnings growth while capturing market share within specialized defense and utility segments.

Institutional sponsorship is another strong point for ESCO. Major holders include Vanguard Group (~11.5 percent), Dimensional Fund Advisors, and Geneva Capital Management.¹² The presence of top-tier funds, combined with recent analyst upgrades and raised guidance for full-year EPS (now projected at $5.65 to $5.85), suggests growing confidence in the company’s strategy and long-term execution.¹³

Finally, broader market direction also supports ESCO’s outlook. The industrial and defense sectors are experiencing tailwinds tied to infrastructure investment and national security priorities. The general uptrend in equity markets, coupled with ESCO’s strong fundamentals, positions the company well to continue its growth trajectory even amid macroeconomic variability.

In conclusion, ESCO Technologies meets all seven of the CAN SLIM criteria with notable strength. It boasts robust current and annual earnings growth, strategic product expansion, breakout price action, strong supply-demand dynamics, market leadership, deep institutional backing, and operates in a favorable macro environment. While valuation risk exists—its price-to-earnings ratio hovers near 40× trailing earnings—the fundamentals suggest ESCO remains a top-tier candidate for growth-oriented investors seeking to align with the CAN SLIM strategy.

Technical Commentary

Trend

The stock has been in a steady uptrend since mid-2023, recently accelerating post-Feb 2025.

The uptrend is supported by increasing volume, a bullish confirmation of strength.

Breakout Zone

The highlighted zone ($166.95 – $175.00) was prior resistance.

ESE has clearly broken out above this resistance, now testing it as new support.

Volume Confirmation

Volume is elevated during the breakout candle, a hallmark of institutional buying.

Sustained volume at these levels above resistance suggests accumulation, not distribution.

Support Levels

$175 is now key support, reinforced by historical consolidation and breakout confirmation.

Secondary support around $167.

Price Action

The candle for the current week (ending June 12) is positive: higher high, higher low, and a close near the top.

Suggests bullish continuation unless a reversal candle appears next week.

Next Resistance / Targets

With no major prior resistance overhead, the stock is in price discovery mode.

Psychological round numbers like $200 and $225 may serve as next resistance targets.

Footnotes

Yahoo Finance, “ESCO Technologies (ESE) Q2 2025 Earnings Report,” accessed June 12, 2025, https://finance.yahoo.com

Zacks Investment Research, “ESCO Technologies Surpasses Q1 Earnings Estimates,” accessed June 12, 2025, https://www.zacks.com

MarketWatch, “ESCO Technologies Q2 Financials,” accessed June 12, 2025, https://www.marketwatch.com

ESCO Technologies, “Annual Report FY2024,” ESCO Investor Relations, accessed June 12, 2025, https://investor.escotechnologies.com.

Ibid.

ESCO Technologies, “Q2 2025 Earnings Presentation,” accessed June 12, 2025, https://investor.escotechnologies.com.

GlobeNewswire, “ESCO Technologies Acquires SM&P,” published April 25, 2025, https://www.globenewswire.com

TradingView, “ESE Technical Chart (Weekly),” published June 12, 2025, https://www.tradingview.com

Finviz, “ESE Overview,” accessed June 12, 2025, https://finviz.com

Nasdaq, “ESE Short Interest and Float Data,” accessed June 12, 2025, https://www.nasdaq.com

Investor’s Business Daily, “Relative Strength Ratings for ESE,” accessed June 12, 2025, https://www.investors.com

Morningstar, “ESCO Institutional Ownership,” accessed June 12, 2025, https://www.morningstar.com

The Motley Fool, “Analyst Commentary on ESCO Technologies,” accessed June 12, 2025, https://www.fool.com

Disclaimer:

This analysis is intended solely for informational purposes to highlight stocks that may be worth considering for further research. It does not constitute investment advice or a solicitation to buy or sell any security. The content is general in nature and reflects the author's opinion based on publicly available information at the time of publication. Every investor has unique goals, risk tolerance, and financial circumstances. Before making any investment decisions, readers are strongly encouraged to seek out personalized advice from a qualified financial professional to ensure any investment aligns with their individual objectives and long-term strategy.